Qualified Charitable Donations External Link

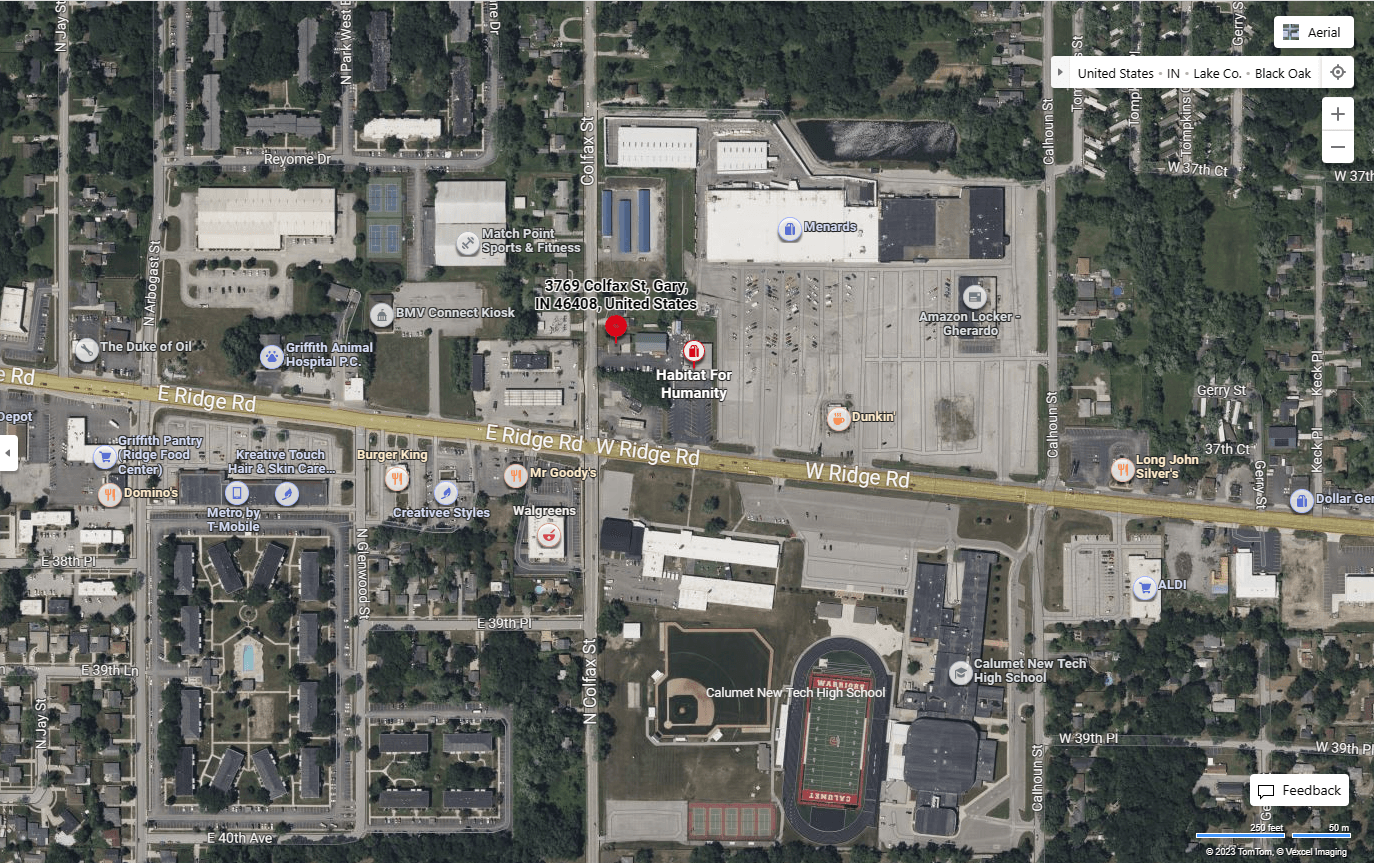

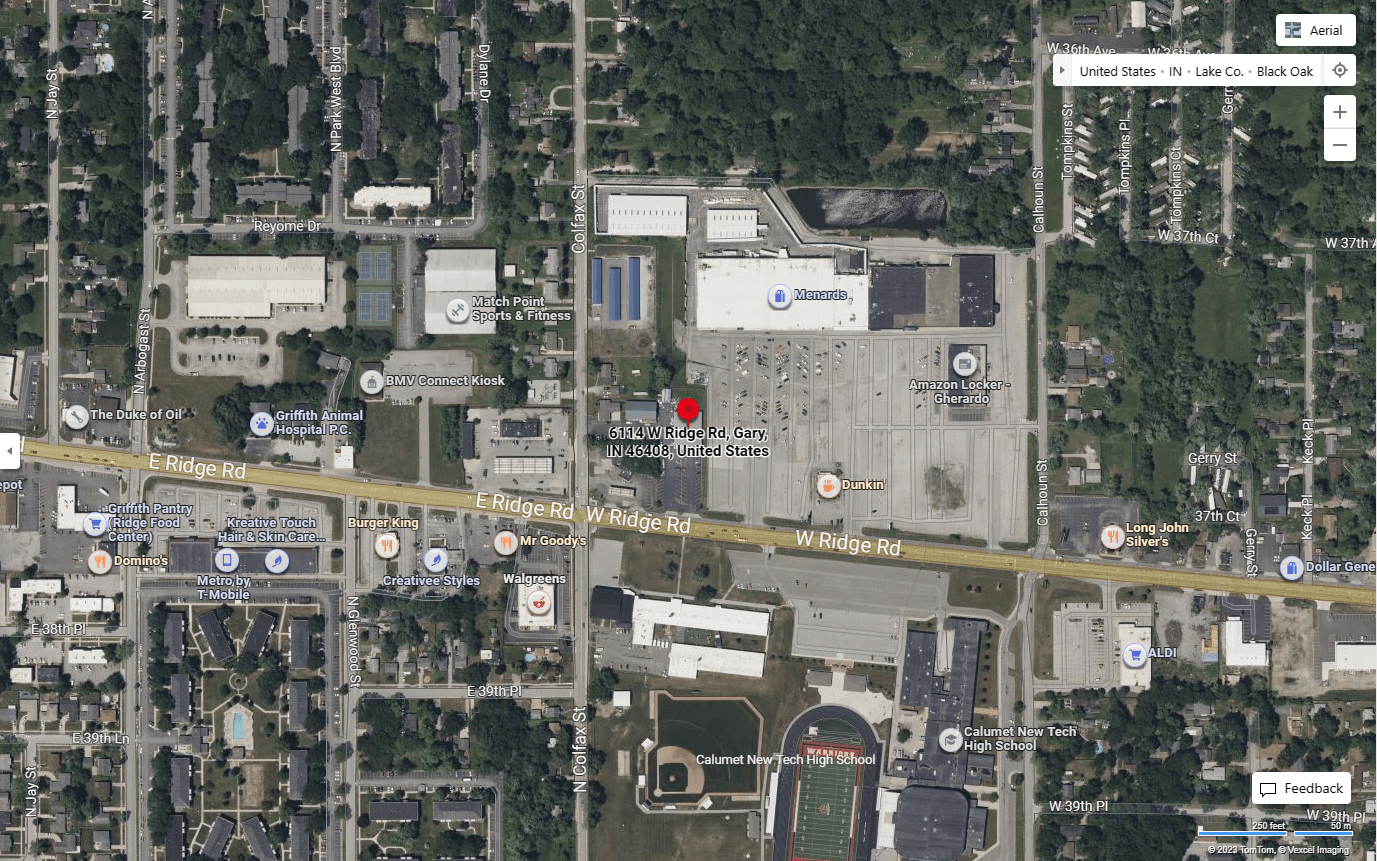

If you are 70.5 or older with a traditional IRA, you’re eligible for one of the most tax-savvy ways to support Habitat for Humanity of Northwest Indiana: donating directly from your IRA. This is also called a Qualified Charitable Distribution, QCD, or an IRA Rollover:

- QCDs can only be taken out of an IRA. 401ks do not qualify and are subject to regular taxes.

- Gifts are always tax-free, regardless of whether or not the person itemizes on their return. This is one of the only ways to make a donation without dipping into your taxable income.

- You can give up to $100,000 out of your IRA tax-free.

Just like donating via cash or check, giving from your IRA is an immediate and impactful way to support Habitat for Humanity of Northwest Indiana — but unlike a cash gift, it helps you save on your taxes.

Now is the perfect time to make this kind of donation. Gifts from an IRA need to be processed by Habitat for Humanity of Northwest Indiana before December 31st, so making your gift today ensures that it will count for your 2023 taxes.

Donating through your IRA doesn't have to be complicated or stressful; our online platform makes it painless and fast. You will be guided through the donation process in under 10 minutes; no sensitive information is required. Your paperwork will even be auto-completed online.

Visit FreeWill.com/QCD/HabitatNWI to give or learn more about IRA giving today.

Required Minimum Distributions

- Each year, you are normally required to remove a minimum amount for your IRA in a Required Minimum Distribution, or RMD.

- In 2020, RMDs were waived as a result of The CARES Act. This means for some, RMDs may be higher than before.

- Many people remove more than this minimum amount from their IRA, and in the past, generous donors have turned their RMD directly into an IRA donation, taking it as a philanthropic opportunity to donate to Habitat for Humanity of Northwest Indiana.

Frequently Asked Questions

Can you clarify how exactly a QCD would reduce my tax burden?

Normally, if you withdraw funds from your Traditional IRA, they count toward your annual income. This will increase your overall tax burden, and in some cases, it may even move you into a higher tax bracket.

However, IRA gifts are generally an exception to this rule—funds go directly from your IRA to your chosen charitable organization without needing to be withdrawn, thereby helping you avoid higher income taxes. That’s why, when you donate from your IRA instead of withdrawing funds, you reduce your tax burden!

What is a Required Minimum Distribution, and do I need to take one?

Required Minimum Distributions (RMDs) are the amount of money IRA account holders have to remove from their IRA each year. If you do not take these funds out of your account, you will be taxed heavily on the remaining amount. If you take the funds out of your account, they will be subject to regular state and federal income taxes. If you are 72 years old or older, you must take the RMD.

When am I eligible to make a QCD?

You must be 70.5 or older to make a Qualified Charitable Distribution.

Is it still beneficial to make a QCD before taking my RMD?

Yes! By making a QCD before taking an RMD, you can potentially lower your RMD in the future. These gifts are also tax-free, even if you don’t need to take the RMD.